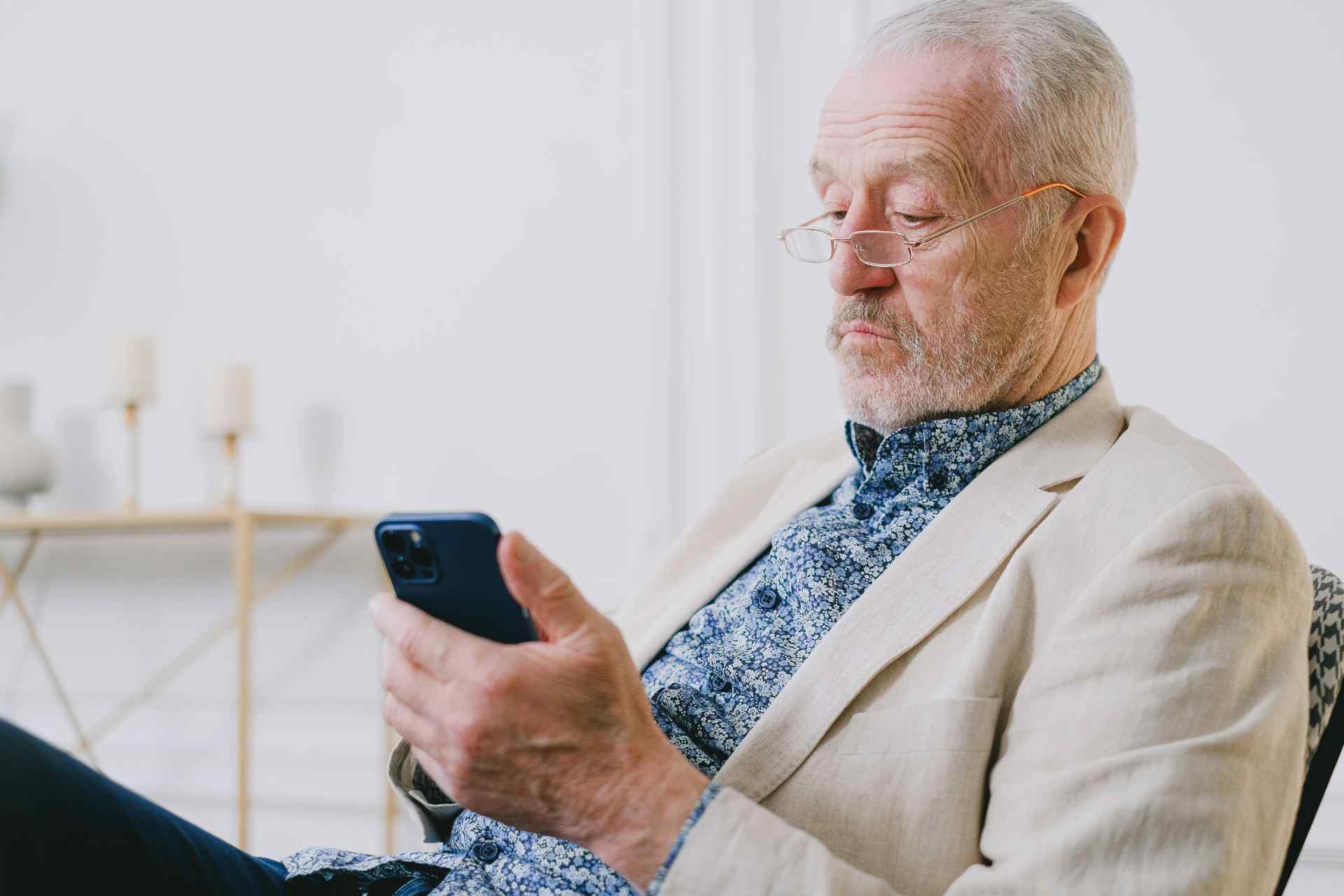

If you’ve been scammed, you’re not alone. We have teamed up with Age UK Oxfordshire to help you understand how to avoid scammers, this time specifically considering common telephone scams.

Age UK has published a comprehensive report following extensive research which involved surveying 10,000 people over the age of 50. The report produced reveals that over 41% have been scammed over the last five years, losing an average of £2,022. Of those, 22% have never recovered the lost money.

Age UK has also revealed that each year, around 1 in 12 people fall victim to scams, which equates to approximately 940,000 older people a year. According to the organization, an undercurrent of fear of scams is affecting the daily lives of some older people and, two years ago, it launched a Fraud and Scams Support Service funded by Lloyds Banking Group to help those at risk or affected by this type of crime. To view the information and advice take a look at the Age UK website.

In April 2024, the publication ‘Which?’ released an article stating that five million over 50s fear answering the phone due to scams risk, citing Age UK’s research that reveals four people over 50 are scammed every minute.

We have written a series of blogs on the subject of identifying and avoiding scams, including over the phone, on the internet and on your doorstep. Read on to discover our guide to spotting online scams, written in association with Age UK Oxfordshire.

If someone is requesting sensitive personal or financial information, money or investments over the phone, on the doorstep, in an email, online, in a text message, on a dating site, facebook page, marketplace or even on your doorstep, you might be dealing with a scammer.

Scammers telephone their intended victims, pretending to be reputable companies asking for information.

Sometimes it’s hard to tell the difference between a scam and cold calling but do be aware of the possibility of scammers. The people behind the scams can mimic official telephone numbers such as those of banks and utility companies – so it seems as if they are official. If they know your name, address, bank, or utility company, it doesn’t mean they are legitimate.

Report fraud and scams to Action Fraud. If you report a scam, it gives the police information that can be used to warn other people. Action Fraud is the UK’s national fraud and internet crime reporting unit. The telephone number is 0300 123 2040 and you can contact them online on www.actionfraud.police.uk.

This type of scam often includes attractive offers that aim to persuade you to transfer your pension pot or to release funds from your pension.

Be wary of any scheme offering to help you release cash – this could be described as ‘a pension loan’ or ‘pension liberation’ – allowing you to borrow money from your pension fund.

If you take up the offer, your pension funds will be transferred into a scheme set up by the scammer, usually based abroad, and you may be ‘loaned’ an amount – often half your pension with the company taking a fee of as much as 30%.

You could also face a tax bill of 55% on what you withdraw, even if you put the money back in your pension or have paid fees or charges to the company involved... Once you’ve invested your money in the scam, it may simply be stolen, or a small amount will be invested in high-risk products or properties such as overseas developments.

If you have been contacted unexpectedly and offered a free pension review, it could be a scam.

Professional advice on pensions is not free. Some scammers may even say they are acting on behalf of the FCA or another financial organisation.

If you are worried about a potential scam or may have been scammed, contact the FCA on 0800 111 6768 or use the online contact form at www.fca.org.uk.

The UK’s telephone network is changing. By 2027, most telephone providers will be moving their customers from analogue landlines to new upgraded landline services using digital technology.

The reason for this is to provide a future-proof, more reliable broadband service that will support the UK in the coming years. Services that rely on the old landline system such as home phones and healthcare devices will be switched over.

This switchover is giving fraudsters an opportunity to scam vulnerable people, tricking them into providing personal information including bank account details and passwords.

Around 1.8 million people use healthcare devices, and the reports of scams are set to increase as the January 2027 switchover date approaches. It is important to be aware of callers who say they are working with the NHS and say that you will be disconnected unless they handover their personal details such as bank details. Scammers are using emails, text message and telephone calls to solicit these details. The deadline date has changed on several occasions over the past few months, so we recommend always checking in with reputable sources to see the latest deadline, should it move again, including the BBC, or official government websites - not cold callers.

If you're from Oxfordshire and have been affected by scams and would like to discuss a one-to-one visit with Age UK Oxfordshire, or would like to organise a group talk to raise awareness of scams please get in touch by emailing [email protected] or call 0345 450 1276.

You are also able to find information about your local Age UK Office here, who will be happy to support you.

Age UK also run their “Age UK Advice Line” on 0800 678 1602, a general telephone line with operatives who will be able to give you advice, and direct you towards resources to help you. The line is open 8am to 7pm every day of the year.

Action Fraud is the UK’s national fraud and internet crime reporting unit. The telephone number is 0300 123 2040 and you can contact them online on www.actionfraud.police.uk.

29 May 2025

There are at least 12 different terms to describe retirement housing including extra care housing, housing with care, independent…

Read more9 May 2025

If you enjoy travelling within the UK, there are plenty of financial benefits related to retirement. It’s easy to leave the car…

Read more7 April 2025

From beautiful landscapes to excellent transport links, Kent offers the best of both worlds - convenience and charm - along with…

Read more